Hello INDODAX Members,

As part of our commitment to comply with government regulations regarding cryptocurrency taxation, INDODAX — a secure and trusted crypto exchange in Indonesia — will implement a tax fee adjustment in accordance with the Minister of Finance Regulation (PMK) No. 50/2025 concerning Value-Added Tax (VAT) and Income Tax (PPh) on crypto asset transactions.

This adjustment will take effect on Friday, August 1st, 2025, at 00:00 WIB (UTC+7) for all trading pairs in the IDR and USDT markets listed on INDODAX.

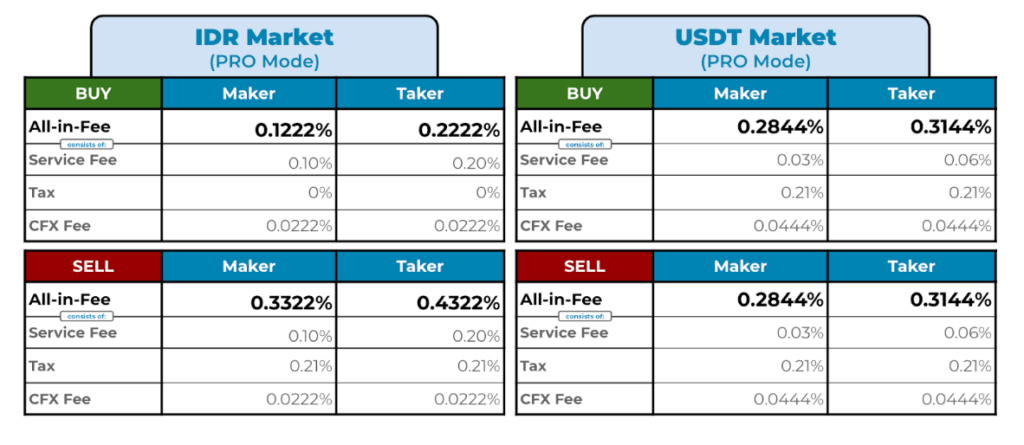

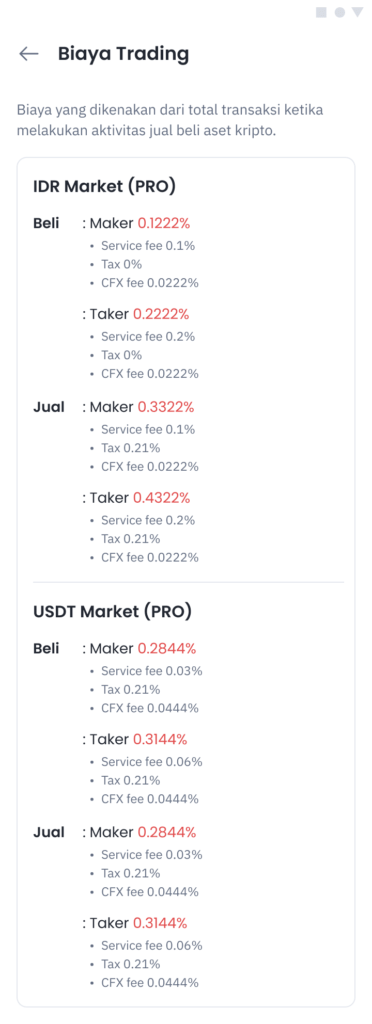

The adjustment applies to the tax component within the all-in fees (trading fee + tax + CFX fee), whereby the purchase of crypto assets will no longer be subject to Value-Added Tax (VAT), and the sale of crypto assets will be subject to an Income Tax (PPh) rate of 0.21%, in accordance with the provisions of PMK Number 50/2025.

Here is the breakdown of the adjusted rates for the IDR and USDT markets on INDODAX:

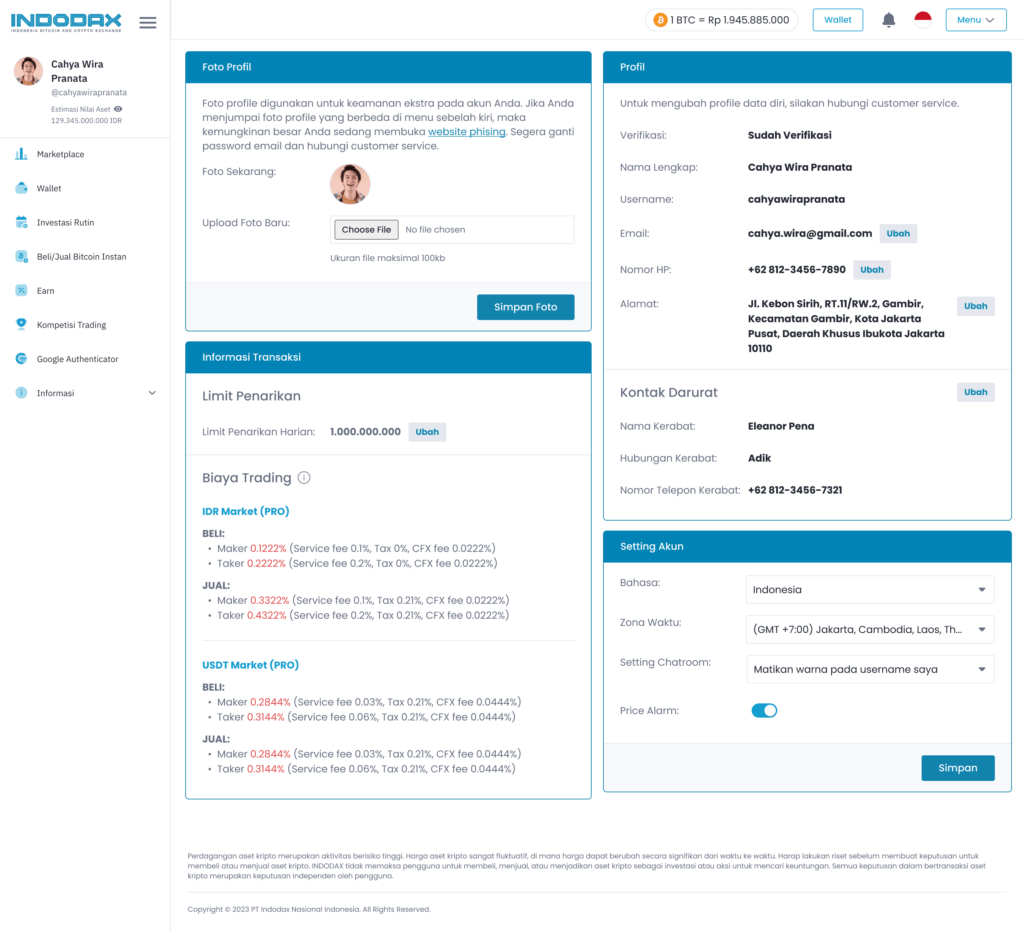

How to View the All-In Fee After Adjustment on the INDODAX Website:

- Go to the Menu dropdown on the upper right side

- Click Profile & Settings

- A Transaction Information section will appear with the Trading Fee breakdown that shows service fee, tax, and CFX fee details

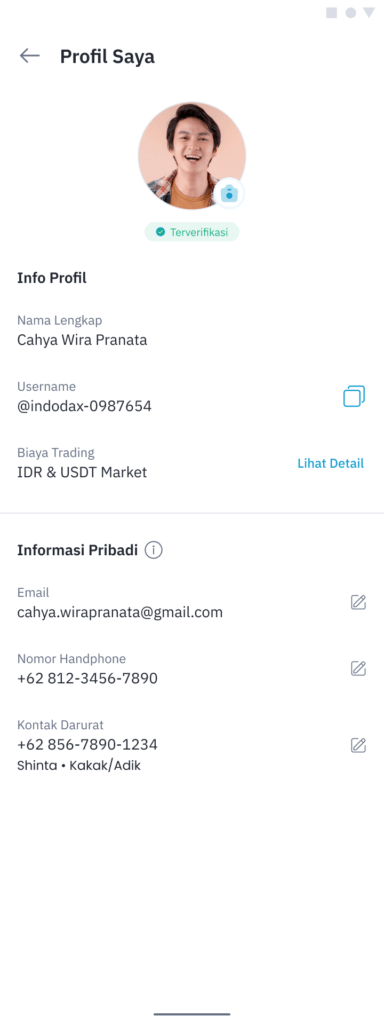

How to View the All-In Fee After Adjustment on the INDODAX Mobile App (Pro Mode):

- Go to the Profile menu on the upper right side

- Click Personal Settings and click See Details on the Trading Fees section

- The Trading Fee breakdown will appear, showing the service fee, tax, and CFX fee details

For further questions and information, please contact INDODAX Customer Support via email at [email protected] or through the phone number (021) 50658888

Regards,

INDODAX – Indonesia Bitcoin & Crypto Exchange