Hello, INDODAX Members,

In alignment with UU No. 7 of 2021 concerning Harmonization of Tax Regulations (HPP) and PMK No. 81 of 2024, INDODAX will implement an adjustment to the 12% VAT rate. INDODAX will implement a 12% VAT adjustment, which will affect the total transaction fees (all-in-fee) for buying and selling crypto assets on INDODAX. This includes trading fees, taxes, and CFX fees.

The implementation of the 12% VAT adjustment will be effective as of Wednesday, January 1st, 2025, at 00:00 WIB (UTC+7) and will apply to all trading pairs in the IDR and USDT markets listed on INDODAX.

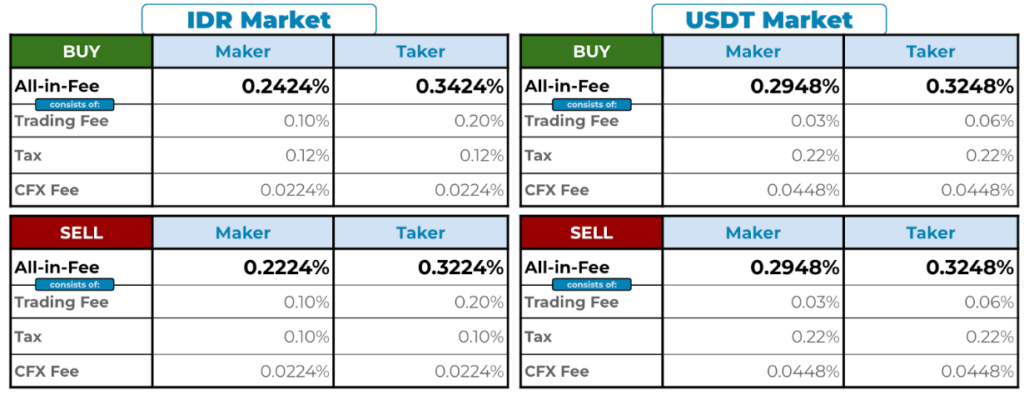

The 12% VAT adjustment applies to the Tax component:

- Market IDR: Applies only to the Buy side, with the tax component adjusted from 0.11% to 0.12%.

- Market USDT: Applies to both Buy and Sell sides, with the tax component adjusted from 0.21% to 0.22%.

Additionally, the 12% VAT also impacts the CFX Fee:

- Market IDR: An adjustment of 0.0002% has been made to the CFX Fee, updating it from 0.0222% to 0.0224% for both Buy and Sell sides.

- Market USDT: An adjustment of 0.0004% has been made to the CFX Fee, updating it from 0.0444% to 0.0448% for both Buy and Sell sides.

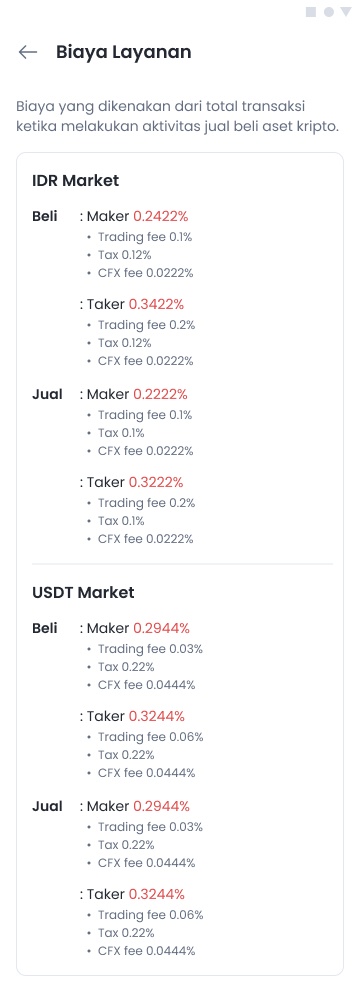

Here’s the details of the 12% VAT adjustment in the IDR and USDT market on Pro mode:

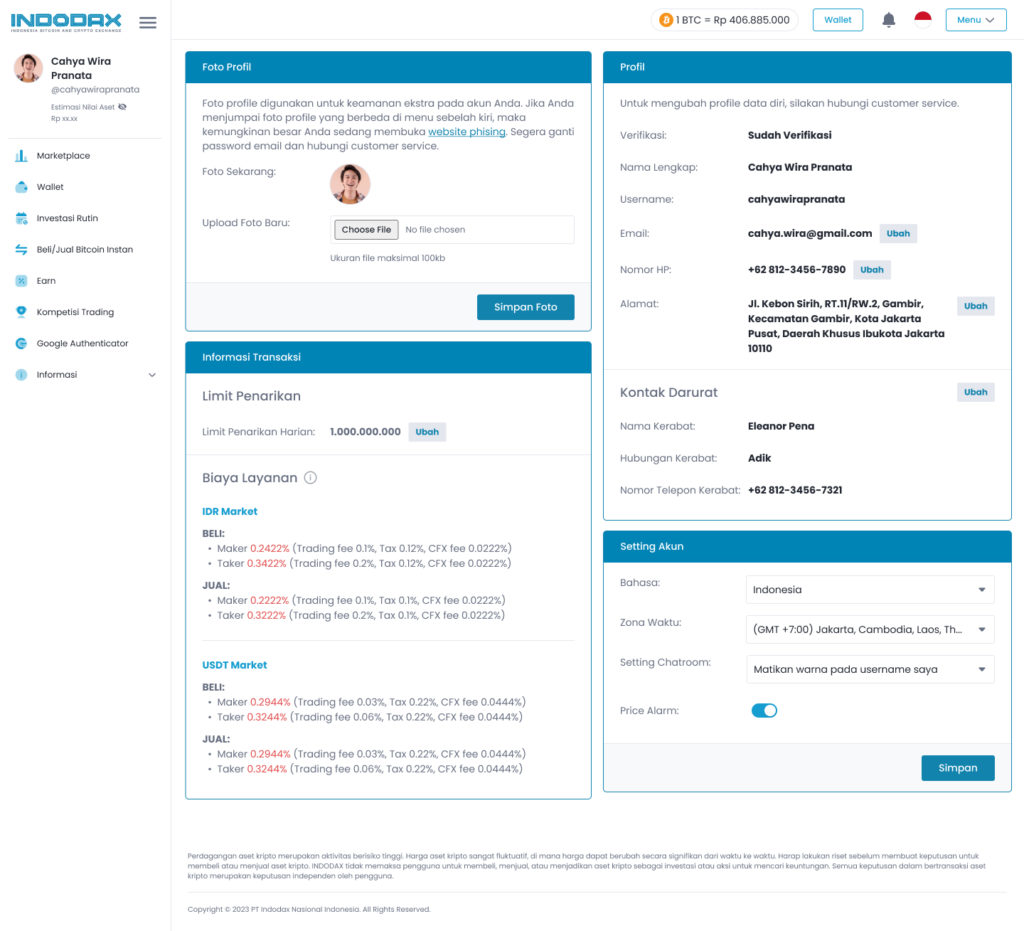

Here’s how to view the details of the all-in-fee from 12% VAT adjustment on the INDODAX website:

- Go to Menu dropdown on the upper right side

- Click Profile & Setting

- A Transaction Information section will appear with the Service Fee breakdown that shows trading fee, tax, and CFX fee details

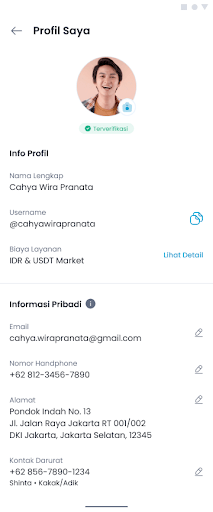

Here’s how to view the details of the all-in-fee from 12% VAT adjustment on the INDODAX mobile app with Pro or Lite mode:

- Go to Profile menu on the upper right side

- Click Personal Settings and Click See Details on Service Fees section

- The Service Fee breakdown will appear that shows trading fee, tax, and CFX fee details

Notes: INDODAX will implement the 12% VAT rate in accordance with the previous official information from the government.

For further questions and information, please contact INDODAX Customer Support via email at [email protected] or through the phone number (021) 50658888.

Best regards,

INDODAX – Indonesia Bitcoin & Crypto Exchange.