Hello INDODAX Members,

Reading tax regulations allows for multiple interpretations, but the interpretation written here has been through consultation/clarification with the Tax Authority. If regulations change during development, INDODAX will continue to provide updates to Members.

In connection with the implementation of the latest policy regarding Value Added Tax (VAT), INDODAX will adjust the VAT rate, which will be effective starting January 1st, 2025. This adjustment is made as a form of compliance with the Regulation of the Minister of Finance (PMK) No. 131 of 2024 and PMK No. 81 of 2024, which regulates VAT rates for crypto asset transactions and certain other goods.

The VAT rate for crypto asset purchase transactions made through registered Physical Crypto Asset Traders (PFAK), including INDODAX, is now set at 0.12% (1% x 12%) of the transaction value. Meanwhile, other transactions, such as deposit fees, rupiah withdrawal fees, and trading fees, are subject to an effective VAT rate of 11%, in accordance with the provisions of PMK No. 131 of 2024 Article 3.

PMK No. 131 of 2024 states that the tax base is calculated at 11/12 of the transaction value for certain goods that are not classified as luxury goods. However, crypto buying and selling transactions are specifically regulated in PMK No. 81 of 2024, so the effective rate for purchasing crypto assets still refers to these provisions. This rate is designed as a form of special tax treatment for crypto assets, considering their different nature from goods or services in general.

However, in connection with the implementation of the latest policy regarding Value Added Tax (VAT) where the VAT tax will return to 11%, INDODAX will adjust the VAT rate, which will be effective starting Thursday, February 13, 2025, at 11.00 WIB. This adjustment is made as a form of compliance with the Minister of Finance Regulation (PMK) No. 11/2025 regarding the latest tax regulation updates.

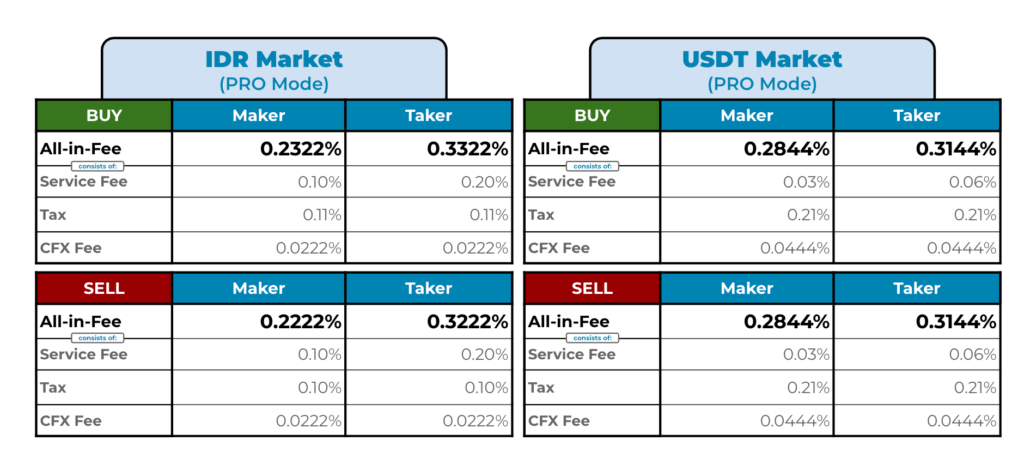

Therefore, the following is an adjustment of 11% VAT to the transaction fee structure at INDODAX on the IDR and USDT markets in Pro mode, to the total transaction fee (all-in-fee) of INDODAX, which consists of (trading fee + tax + CFX fee):

For transaction convenience, INDODAX Members are advised to adjust their trading activities according to the changes. In addition, members are also advised to cancel (cancel order) limit order transactions that are still open (open orders) made since January 1st, 2025, at 00.00 WIB. After the VAT rate adjustment is made, members are advised to create a new order so that the tax adjustment in the system is in line with the new government policy.

Notes: INDODAX will implement the provisions for applying 12% VAT in accordance with government regulations. If, after this implementation, there is a difference in the imposition of VAT, INDODAX will carry out a refund mechanism on Thursday, February 13, 2025, which will apply to the CFX Fee and Deposit Fee.

For further questions and information, please contact INDODAX Customer Support via email at [email protected] or by phone at (021) 50658888.

Regards,

INDODAX – Indonesia Bitcoin & Crypto Exchange