Oscar Darmawan, CEO of Bitcoin Indonesia, draws an illustration of blockchain technology.

Oscar Darmawan, CEO of Bitcoin Indonesia, draws an illustration of blockchain technology.

Oscar Darmawan sits alone at Luciole Bistro at Central Park in West Jakarta. When I enter, he stands and shakes my hand warmly and talks a little about his past. He’s soft-spoken and young-looking. His appearance reminds me of the shy kid in science class who has all the answers in his head and will share them if only you ask nicely. As we start our conversation, he politely orders spaghetti carbonara, and tries to get a sense of how much I know. He then pulls out a laptop and shows me how to buy a brick of heroin online. A few mouse clicks later, we’re browsing for illegal arms on the dark web.

He doesn’t look like a dangerous man, but he is the smartest guy in the room. Darmawan is the CEO of Bitcoin Indonesia, an exchange where folks can buy and sell the controversial cryptocurrency known as bitcoin, a form of digital money that’s more secure than any bank in the world, all but impervious to regulation, flawless and complete in its ledger, 100 percent public, and virtually untraceable for those who use it. Darmawan graduated with an IT degree from Monash University in 2006, then went to help carry out cyber security projects for private companies, militaries, and government organizations in Indonesia and Singapore. He’s not allowed to share the details.

If you don’t know what bitcoin is, don’t worry. Chances are you’re a normal person who’s just never considered alternatives to money as we know it. Inherently, bitcoin is neither a malicious nor a benevolent thing. It’s just another currency. Just like any other form of money, bitcoin’s value and strength against other currencies fluctuates by the minute. At the moment, one bitcoin is valued at US$256, as per data from CoinDesk’s real-time charts. The real miracle, however, isn’t that the nerds have come out with a new form of currency, it’s that enough people in the world have decided bitcoin possesses intrinsic value. It’s exactly this consensus which makes it real today; a self-fulfilling prophecy.

Currently, Darmawan’s company facilitates transactions of between 200 and 400 bitcoins per day with more than 68,000 registered members. “It’s kind of funny because I don’t really care about bitcoin,” says Darmawan. “To be honest, I am not a bitcoin believer in terms of price, but I really believe blockchain technology will eventually change the way the system works.”

The fact that you can use bitcoin for semi-anonymous trans-national crime is less of an indictment of the tech itself, and more of a reflection of how the world is about to change. Arguably, most banks, governments, and regulators don’t seem to get it, and are perhaps even afraid of its disruptive potential. But again, the real disruption isn’t bitcoin itself. It’s the little-understood technology behind it: the blockchain.

The building blocks of democracy

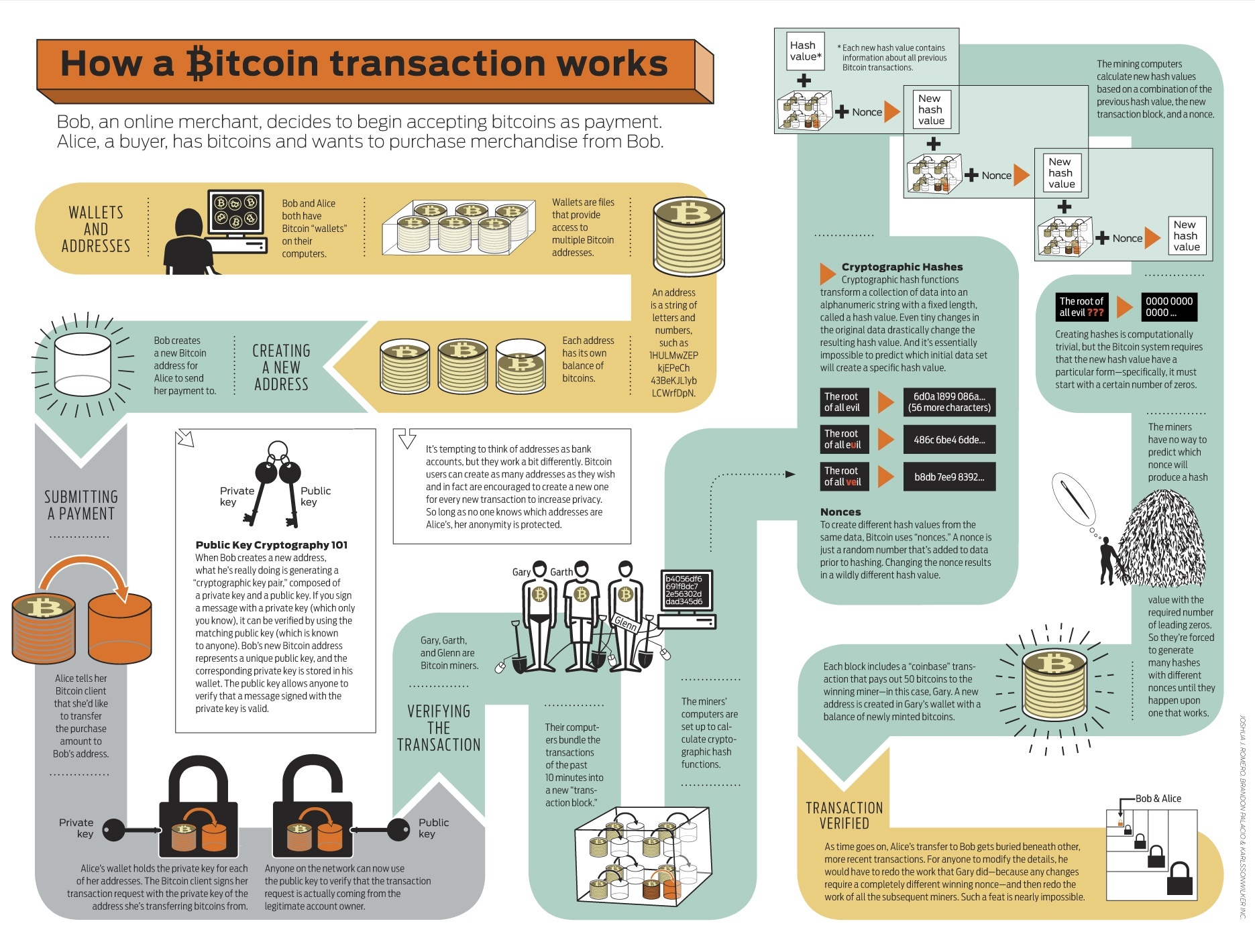

I’ll try to break it down as simply as I can. A blockchain is nothing more than a record of online events. The ledger is public, and shared among all the different parties on a network – nodes on the blockchain. It can only be updated by consensus from a majority of the users in the system. Additionally, once entered, the history is permanent and can never be deleted… ever.

Still with me? Because of this, the bitcoin blockchain contains a verifiable record of every transaction ever made. The key thing to remember is that blockchain tech decentralizes everything. There is no master data center where you’ll find the blockchain’s brain or stacks of overheating servers. It’s designed to mirror and replicate transactions to thousands of other participants, and is therefore everywhere. This has huge implications for emerging markets in Asia Pacific, particularly for governments in places like Indonesia with long histories of corruption and ongoing problems with government transparency.

Because any given blockchain (yes, there are others outside of bitcoin) lacks central leadership, there’s no single person or entity to hold responsible for the stuff it’s used for. Even if you shut one node down, the blockchain will persist without a hiccup. As our friends in the media recently put it, “a blockchain is a highly-distributed, leaderless, jurisdictionless, identityless, nearly anonymous, decentralized architecture for managing ownership.” Sounds a bit like Skynet from Terminator, right? Maybe not yet, but perhaps one day.

What many people — even tech founders — don’t fully understand is that blockchain technology also has profound implications for a variety of sectors, not just cryptocurrency and fintech. Legendary VC and founder of Netscape Marc Andreessen calls blockchain “the most important invention since the internet itself.” It has potential to rework or soup up nearly every industry. A few prime examples include the stock market and traditional banking. But it can also be applied to broader issues like government transparency, smart contracts, legal proceedings, and genome mapping. The virtual sky’s the limit.

There are already a few mad scientists around the world using blockchain outside of currency. With an office in San Mateo, California, Bitproof replaces traditional notary services with a way for anyone to instantly create proof of ownership that is verifiable.

Blockchain can also be applied to the Internet of Things. It can help identify devices so no cyberattack is possible. Devices can turn into nodes that are plugged into a blockchain. From a consumer standpoint, this could mean each appliance in your house can be aware of the others, and carry out functions accordingly. IBM recently did a project with Samsung on how to implement blockchain (in this case Hyperledger) in smart devices like washing machines and TVs.

Blockchain can help increase the transparency and efficiency in the process of land registry, particularly in third world countries and emerging markets where everything is still done on paper.Factom, a decentralized recordkeeping startup, recently partnered with the government of Honduras on a new land title registry initiative. The project will bring about a permanent and secure land title record system in a nation with a history of land rights abuses. This is again something which can be applied to markets like Indonesia, where land acquisition for infrastructure projects is a bona fide plague hampering the nation’s development. (Update 8/21/15: One of our readers reached out to let us know that Factom’s deal with Honduras is not yet final, but still in the works.)

Skola Fund is a Singapore and Malaysia-based company with a blockchain-based crowdfunding platform that matches deserving underprivileged undergrads with funders all around the world who are ready to sponsor their scholarships, student loans, and more. The company is still in the early stages of development, but claims to have already facilitated close to US$4,000 in donations.

The technology is such a fundamental game changer that if used by enough people, blockchain tech could even replace the very fabric of the internet’s domain name system (DNS), rendering centralized hosts like SoftLayer and Amazon Web Services redundant.

A volatile ingredient for Southeast Asia

Darmawan’s spaghetti arrives, but he pushes it to the side because now he’s just too excited about the diagram he’s drawing. Darmawan explains the blockchain’s decentralized nature is the underlying reason we’re able to shop for illegal stuff like heroin and guns on TOR browser (an encrypted internet search engine). It’s also precisely the thing that could solve government corruption in Southeast Asian countries like Indonesia, Vietnam, and the Philippines. In its purest form, blockchain is democracy, says Darmawan. Nobody using it has to know or even trust one another.

Bitcoin Indonesia’s Bali office

Bitcoin Indonesia’s Bali office

He explains:

Centralized architecture will soon be over and replaced by a decentralized one, like how the absolute monarchy has been replaced with democracy […] The blockchain technology can improve many things like […] building the financial sector architecture in a better way and even making government election processes much more effective.

In July 2014, during one of the most fiercely fought presidential elections in Indonesian history, 700 hackers created an organization called Kawal Pemilu, a name which translates to “Protect the Vote.” The group’s mission was to publicly tally up all the election ballots online to let Indonesians cross-check results at each polling station and ultimately prevent election fraud.

The group did not reveal who the initiators or the volunteers were. They called it a precaution to protect members from things like hacking attempts, intimidation, or bribery. Despite several malicious cyberattacks which the group was able to repel, Kawal Pemilu’s mission succeeded and Joko Widodo was elected fairly.

Sound familiar? The basic principle of decentralization, a public ledger, and user anonymity is what protected the vote. If it wasn’t for this group of anonymous hackers, Prabowo Subianto — a manaccused of ordering human rights violations during the fall of Suharto — may have taken office. Now imagine if the group had used blockchain tech, or better yet, if the entire voting process was executed on a blockchain.

Prabowo Subianto, Indonesian presidential candidate in 2014

Prabowo Subianto, Indonesian presidential candidate in 2014

Matthew Martin is the founder and CEO of a Jakarta-based firm called Blossom Finance. The company helps low-income entrepreneurs in developing countries by investing through a network of Islamic-friendly microfinance partners. Prior to Blossom, Martin worked for a number of different VC funded fintech startups. He helped on mobile payments at Boku, money remittances at Xoom, and mobile banking at Monitise.

“Blockchain and government transparency are a perfect fit. Imagine that politicians decide to allocate money towards various projects. Well, blockchain can show their voting record history such that anyone can verify it,” explains Martin. “Let’s say they pass a law to allocate funds for a specific project. Well, a blockchain smart contract could be created and signed by those politicians to automatically allocate funds on some pre-determined schedule toward a project.”

It’s all about accountability. “How do you know the money went to the right place? Using blockchain, you can verify every single rupiah of payment from public money into the project,” he goes on.

“Let’s say you have a project to buy power supplies for schools. Using blockchain, you could show a record of every payment to every contractor and supplier, and also sign off on the project using a digital signature of each school to certify that they received the [supplies]. You could have independent auditors sign off on the project as well using their own digital signatures. All of this would be public record — available for anyone to inspect — and decentralized, meaning it would be impossible to forge, tamper with, or destroy the trail of evidence.”

“The problem with blockchain is that, if implemented, it can keep governments honest,” says Anson Zeall, co-founder and CEO of Singapore-based CoinPip, a company that specializes in sending real money across international borders via blockchain. “The blockchain will be able to record every transaction in the books if implemented in the banking system — encrypted, of course. But it’s a chicken and egg thing. Do corrupt governments want to keep themselves honest?”

In terms of election transparency, Martin states that if each citizen has a cryptographic signature, votes can’t be forged. In this way, it’s possible to make it so voting is anonymous but still verifiable. “Look, government transparency is a huge problem not just in emerging markets. In the US, dead people still show up in the voting record,” claims Martin. “I think that Indonesia and the Philippines have an opportunity to lead the way in terms of building their infrastructure on top of blockchain.”

Election ink is applied to Indonesian citizens’ fingers to help prevent fraud like double voting. If elections were held via blockchain tech, this would be unnecessary.

Election ink is applied to Indonesian citizens’ fingers to help prevent fraud like double voting. If elections were held via blockchain tech, this would be unnecessary.

When big banks bet big

The International Business Times reported last month that Citigroup, the global advisor of multinationals and governments, has built its own digital currency based on blockchain. They’re calling it Citicoin.

Ken Moore, head of Citi Innovation Labs, told the media:

We have up and running three separate systems within Citi now that actually deploy blockchain distributed ledger technologies. They are all within the labs just now so there is no real money passing through these systems yet, they are at a pre-production level to be clear […] Because we are a global network, a global bank, we can look for opportunities to use this technology to move money from country to country.

At the end of July, Citigroup announced it was now actively hunting for blockchain developers in Asia Pacific. As most of the people in the region are unbanked or underbanked — to use the terms for people left out of the banking system or people poorly served by it — the financial juggernaut is likely eyeing Asian emerging markets to test Citicoin. It could also be considering ways blockchain can be used to build a pan-ASEAN form of money, one that knows no bounds and does not live or die based on things like government stability, political risk, or trade deficits.

But not everyone thinks blockchain is the supreme answer. Aaron Chipper is group CTO of Fusion Payments, a firm that lets telcos provide secure mobile payments and checkout services to their customers. “Blockchain tech won’t be the catalyst [for a pan-ASEAN payment solution], but it can certainly play a part in supporting this,” Chipper says. “Right now, we actually don’t use blockchain technology at Fusion, however we are looking at it to help secure our service’s audit trails across multiple products and sites. It’s a fascinating idea […] with massive potential.”

A guy who goes by the name Jake Smith is cited by several Chinese media as the first person to spend bitcoin in China. He’s not big on having his picture taken, and he spends most of his time trying to persuade small businesses to accept bitcoin as payment. He also runs a bitcoin news outlet called The Coinsman.

“The possibility of saving your money in a way that’s not dependent on a shaky local government, or being able to send your money wherever you please and in whatever amount, is something that is potentially game-changing for people in some places,” says Smith via email. “The qualities that allow bitcoin to enable things like drug trading are the same qualities that make it a strong and resilient form of money […] – that is, it does not require those using it to be granted permission from a third party. In fact, the most ideal currency if one wishes to engage in illegal trade would be paper cash, as it is even more anonymous and untraceable than bitcoin is. Bitcoin can just be sent around the world easier.

The multiplier effect

Darmawan brings up an interesting point as I munch on my BLT sandwich. The bitcoin blockchain is the largest and most secure one that exists today, which is why we reference it more than others, but its capacity still needs a significant upgrade if it’s going to handle a mass market of users. Today, the bitcoin network is restricted to a sustained rate of 7 transactions per second because it only allows for blocks of data one megabyte in size. To get a sense of scale, Visa handles on average around 2,000 transactions per second, with an average daily peak rate of 4,000 transactions per second. If the bitcoin blockchain wanted to reach the level of Visa, many experts argue it would need to increase its capacity to a standard block the size of 8 megabytes.

As it stands, the bitcoin blockchain allows for transactions to be processed fluidly, much faster than any bank. However, if more and more people join the blockchain and transact simultaneously, the time it takes for payments to clear will increase, until the wait period could eventually be on par with a normal bank transfer. Remember, a blockchain has no leader. Therefore, a 75 percent majority of users must all agree and take steps together to make this capacity upgrade happen. A good way to think about it is to imagine the way a school of fish moves. Can you tell which fish started the directional movement? Not really. Each fish just swims in a certain direction because the others are.

In the mainstream financial world, Citigroup is not the only institution taking a serious look at blockchain. In May, Singapore’s DBS Bank hosted a blockchain hackathon sponsored by IBM. Through the hackathon, the bank wanted to find use cases of blockchain that could help the unbanked while also optimizing its current systems.

“Big brick-and-mortar retail banks like Citigroup will be obsolete in 10 years,” Martin says bluntly. “It’s no surprise they’re trying to outsource innovation in the ASEAN region. The world already has a cross-border epayment solution: it’s called bitcoin. More processing power is devoted to bitcoin than all of Google’s servers combined. Yes, that’s right – bitcoin and blockchain are bigger than Google. Citigroup was fined US$700 million in the US for illegal credit card practices that directly hurt consumers. Given that kind of track record, consumers should be wary of abandoning the benefits of a decentralized approach by letting these traditional players collude.”

Darmawan looks at me to see if I’ve been able to fully understand what he’s told me. We pause for an awkward moment, and he finally starts eating his food.

We touch base again later through email.

I assume that blockchain will not be the essential technology that would be popularly used by the people in the Asia Pacific region. Although it is correct that blockchain can be the catalyst and perhaps the best solution for this single cross-border payment system to happen, the majority of our people are pretty conservative and they are unlikely to start thinking outside of the box.

An illustration taken from Bitcoin Indonesia’s company deck

An illustration taken from Bitcoin Indonesia’s company deck

A new nervous system

While blockchain technology is far from perfect and still perhaps considered a movement on the fringe of the financial sector, experts know they would be foolish to ignore it. Evangelists suggest a blockchain revolution is already quietly happening in places like Jakarta, Manila, and Ho Chi Minh City without government consent.

“A lot of what I see blockchain being used for is just replacing what already works very well for the developed world,” says Martin. “Payments systems in developed markets already work really well. Why are entrepreneurs trying to fix what’s not broken? 80 percent of Indonesians lack a bank account. That’s huge. That’s a real need. That’s where the opportunity is.”

Darmawan closes his laptop in preparation for his next meeting. We didn’t purchase any drugs online this time round. He shrugs and says there’s really no feasible way for Southeast Asian regulators to shut down or even marginally disrupt blockchain tech. For this reason, they must get onboard with it or suffer at their own risk. According to him, instead of trying to control it, they should simply try to use it to their advantage.

“Blockchain can certainly be the technology that kickstarts this conversation and makes government and regulators think about it,” says Markus Gnirck, co-founder and global COO of Startupbootcamp FinTech in Singapore. “Banks are also starting to look into every possible use case, just driven by the ‘Fear of Missing Out’. This is an exciting time where the mindsets of institutions are changing and [this] finally allows [them] to think in new dimensions. It’s a bit similar to the introduction of the computer, and then the internet.”

These are all bold statements, but never has there been such a time to be bold about democracy and the redistribution of intelligence. No matter where you fall on the spectrums of confidence or fear in relation to blockchain, a couple of things are certain: blockchain tech is incorruptible and here to say. It’s quietly creeping into our daily lives, whether we see it or not. It also desperately needs to be used for financial inclusion and government transparency in Southeast Asia’s emerging markets.

Wrapping up our lunch meeting, Darmawan says it can also save governments tons of real-life money. If a blockchain had been used to let citizens cast smart ballots in the 2014 Indonesian presidential election, the government would have saved Rp 7.9 trillion (US$570 million) in costs.