Hello INDODAX Members,

On May 1st, 2022, crypto asset industry in Indonesia has officially been recognized and gained certainty regarding taxation with the enactment of Finance Minister Regulation (PMK) Nomor 68/PMK.03/2022 that regulates Value Added Tax (VAT) and Income Tax (PPh) on crypto asset transactions.

The enactment of PMK 68 means legal certainty to every crypto asset holder regarding their crypto asset ownership by being subject to final VAT and PPh of a total of 0,21% and 0,42% specifically for USDT pair. This also adds to the recognition of crypto assets as digital commodities that are legally traded in Indonesia.

As part of commitment to comply with the government’s regulation regarding crypto asset taxation and in support of the digital economy in Indonesia, INDODAX presents Crypto Tax Report feature.

Below are steps to download crypto asset tax report on INDODAX:

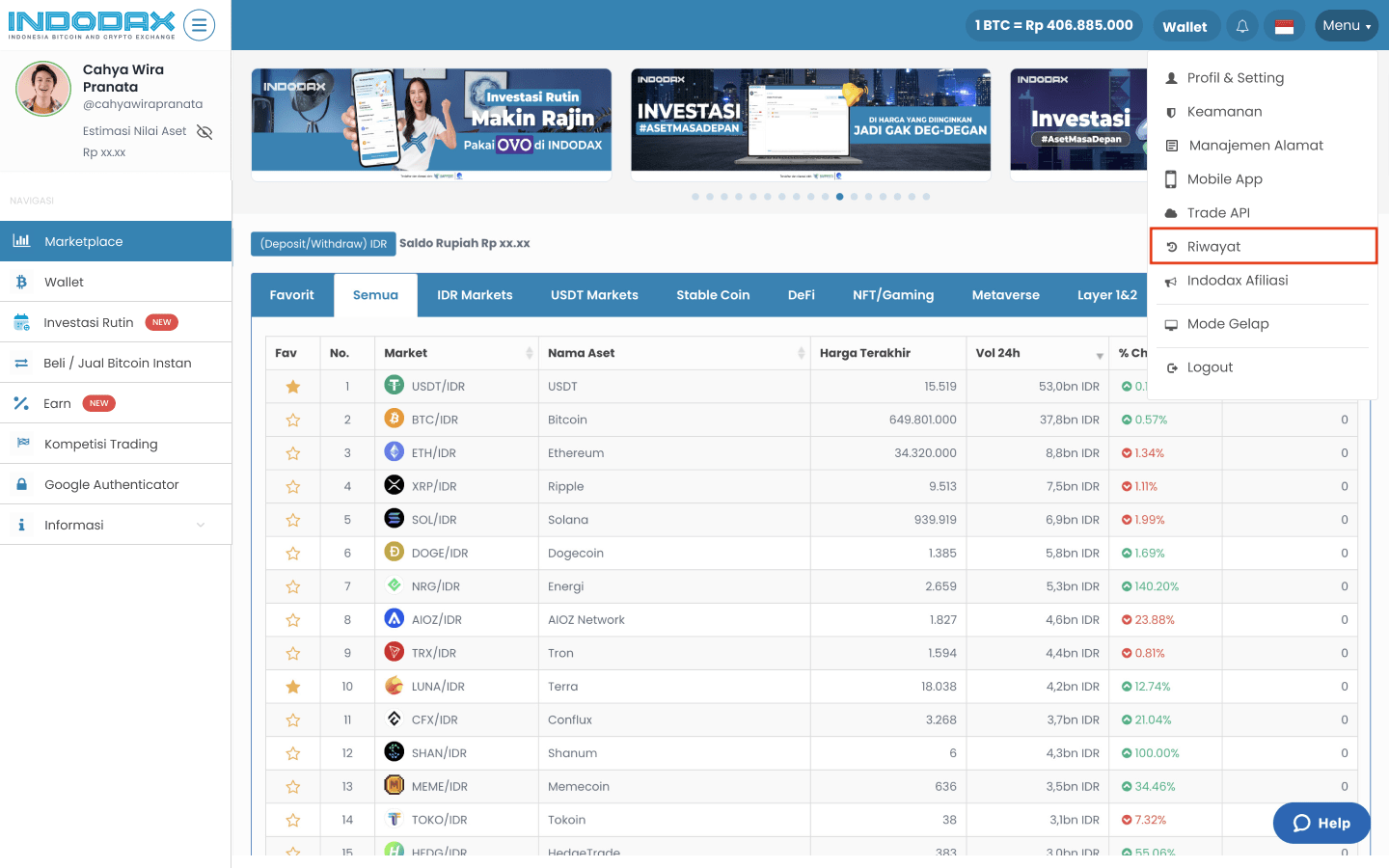

- Visit https://indodax.com/ and login to INDODAX account.

- Enter Menu, click History, and click Tax Report.

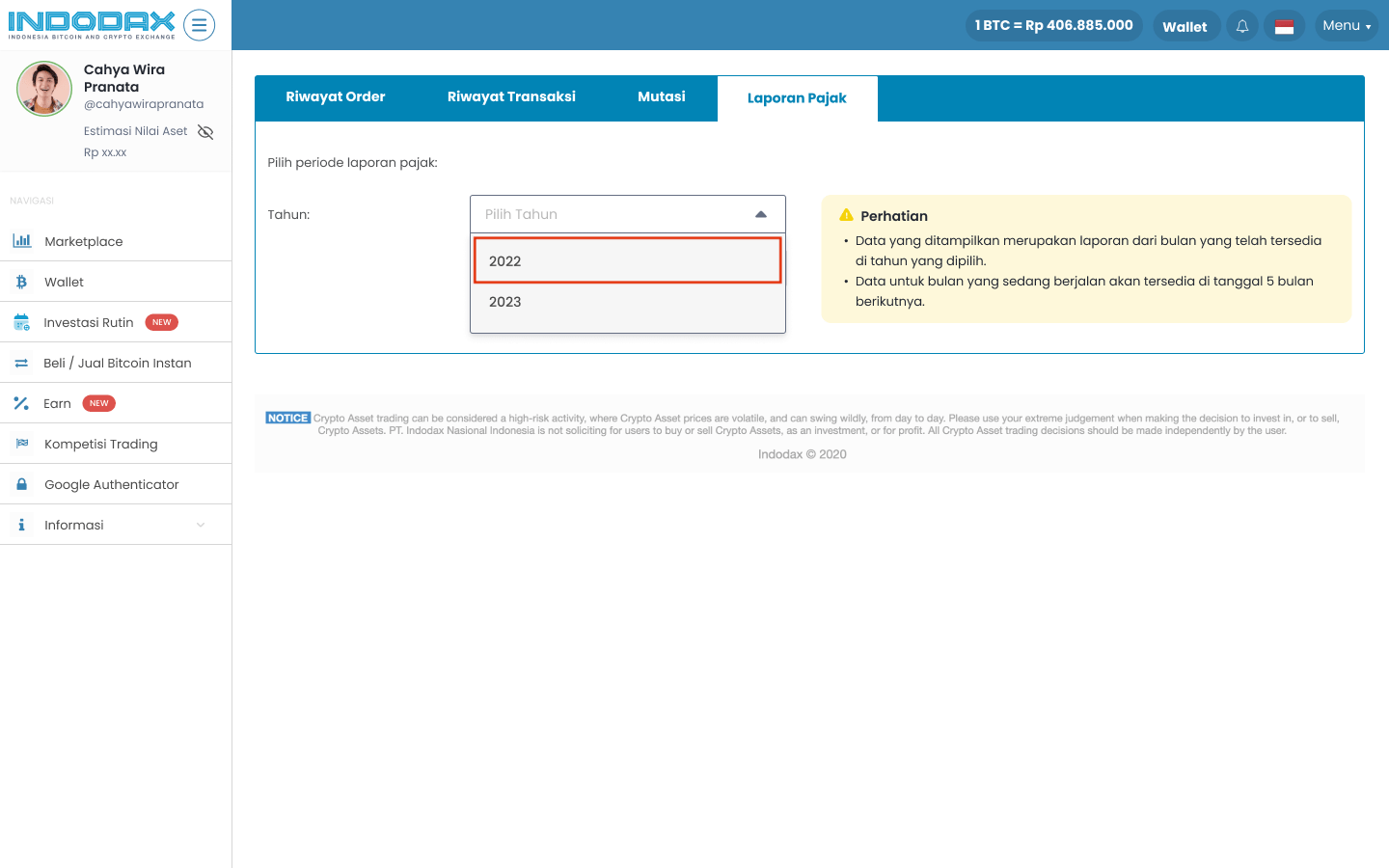

- Next up, select the Year of the desired tax period, then click Show Report.

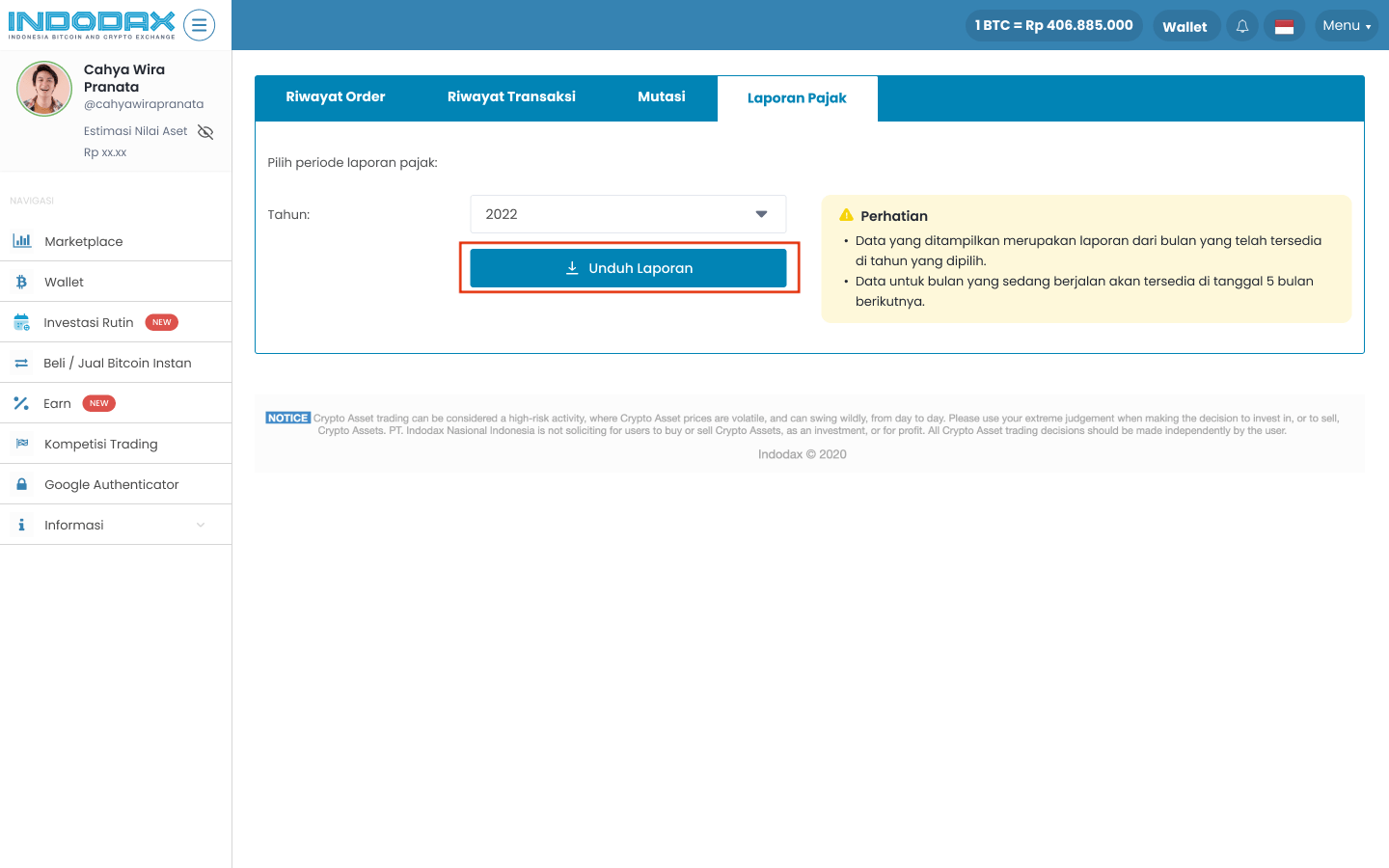

- Then proof of final tax collection from the selected period of time will show up, and click Download Report to get the report in PDF format.

- The crypto asset tax report according to the selected period of time will be automatically downloaded and ready to use. (For users with file sizes <=50MB will get details of each transaction, if >50MB will get a summary view).

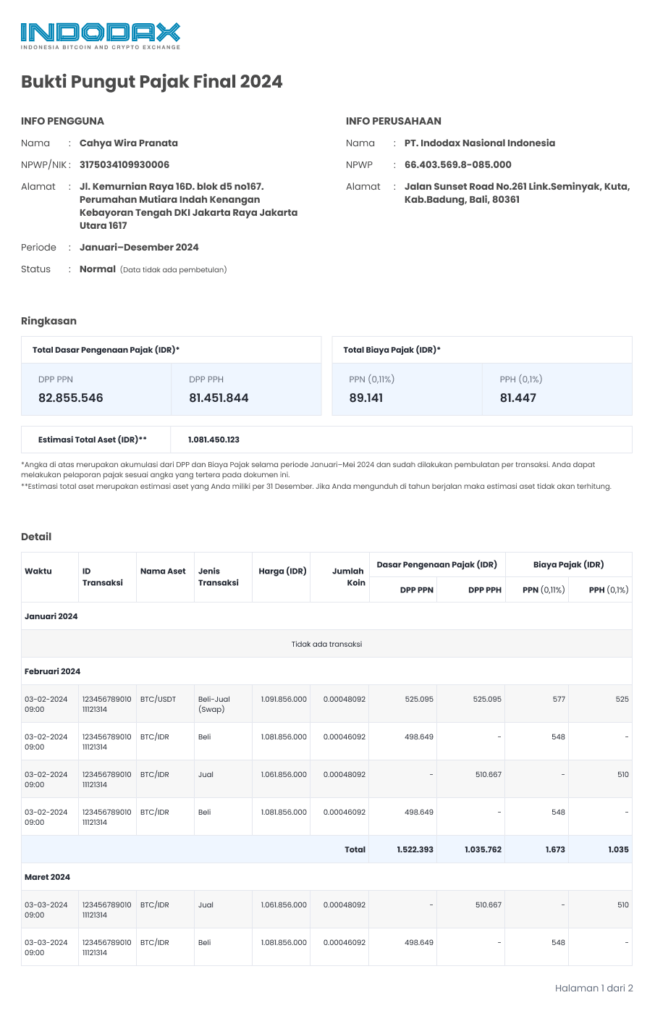

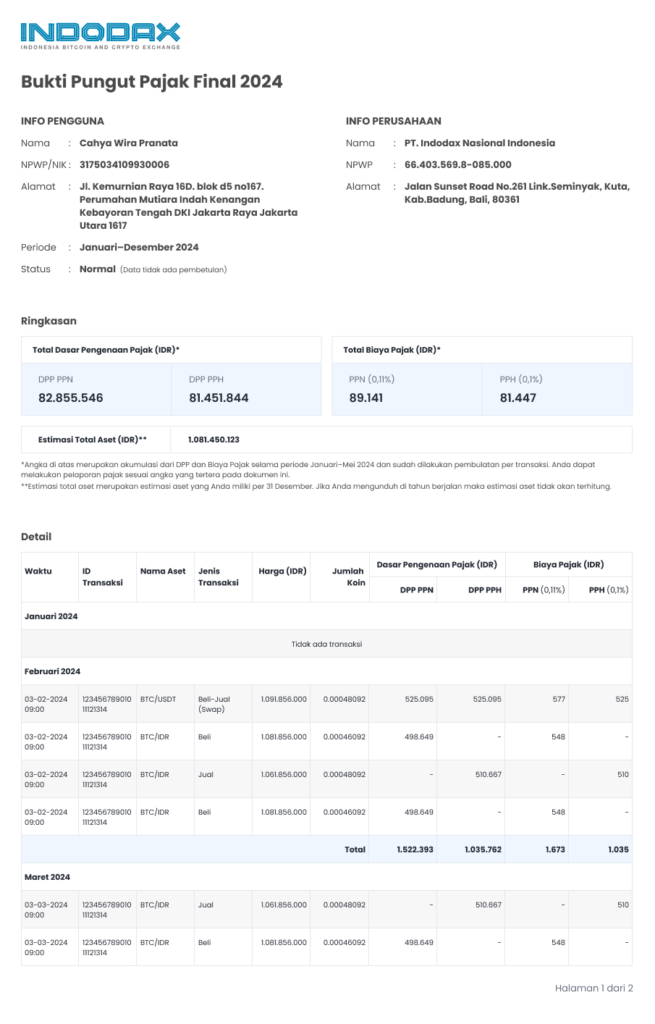

Summary View

Regular View

Please note that there will be a cut-off date for disclosing the latest data before downloading the crypto asset tax report. Monthly data will be generated on the 5th of each month, Members can download the desired month’s data on the 5th of the next month.

To continue the crypto asset tax reporting process on the DJP Online website, follow these steps:

(Disclaimer: The following guidance is for the 1770S form, which is taxpayers with employee status earning over Rp. 60,000,000 in 1 year. INDODAX Member must adjust the stages of filling out the SPT form according to their respective taxpayer status)

- Visit the official website of DJP Online via https://www.pajak.go.id/ and login using ID (NIK) or NPWP, password, and security code

- Enter Report and click e-Filing

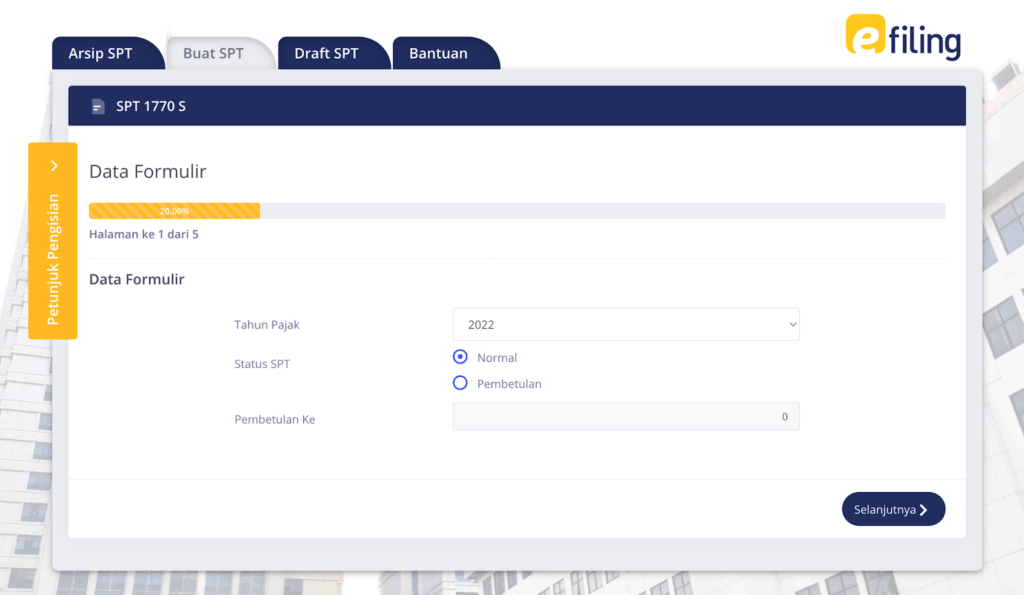

- Next, click Create SPT, fill in SPT Form, and choose SPT 1770S form

- Then, fill in the data and then follow the instructions to fill in the SPT

I. Choose the tax year to be reported and choose SPT Status “Normal” (if it is the first year submission of SPT, not a correction of SPT).

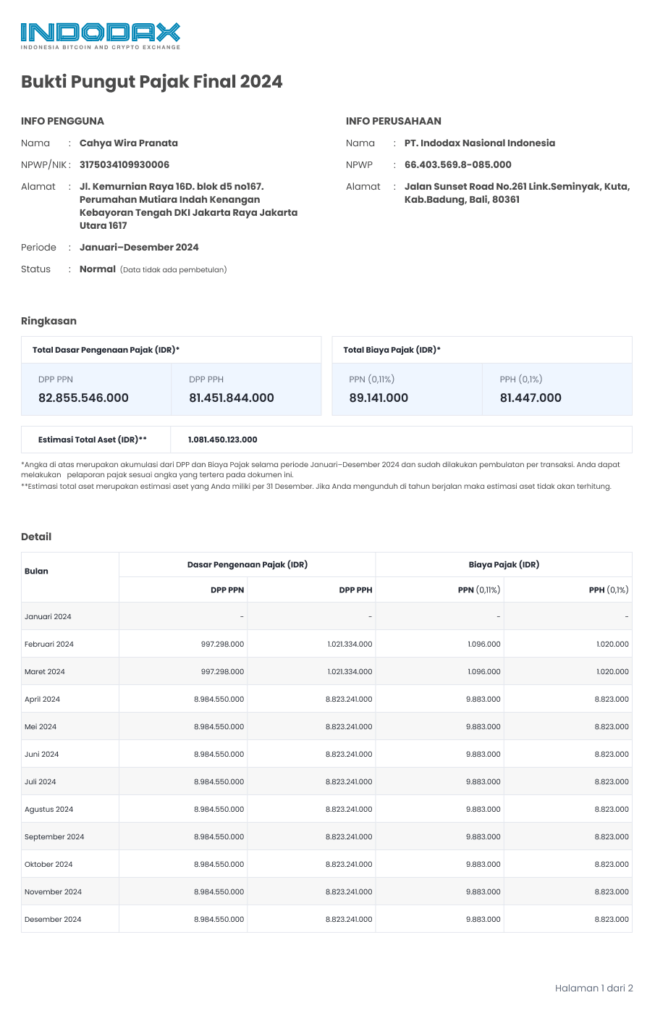

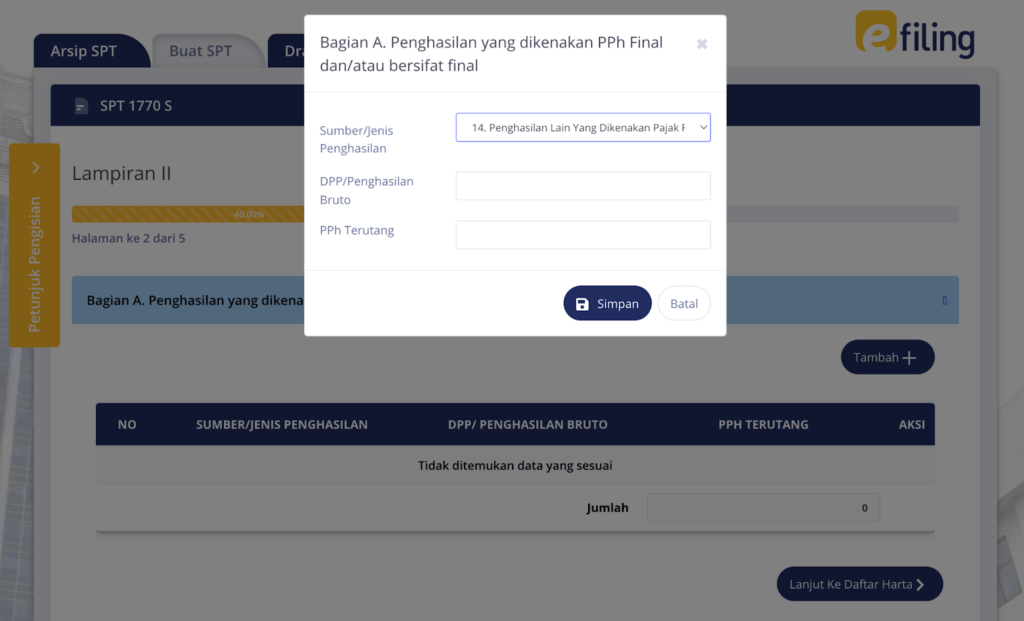

II. In Appendix II: Part A. Income that is subject to PPh Final and/or is final, INDODAX members can input crypto asset transactions facilitated by INDODAX throughout the year using a crypto tax report that has been downloaded.

The DPP/Gross Income column is filled with information on the value of Total Transactions (IDR) – PPh which is the subject of PPh (0.1%), namely sale and swap transactions that took place within 1 year. Keep in mind, INDODAX Members must add up the value of Total Transactions (IDR) – PPh from the period of January to December 2024. Meanwhile, the column for Payable PPh is filled with the value of Tax Fee – PPh (0.1%) related to the transaction value mentioned above.

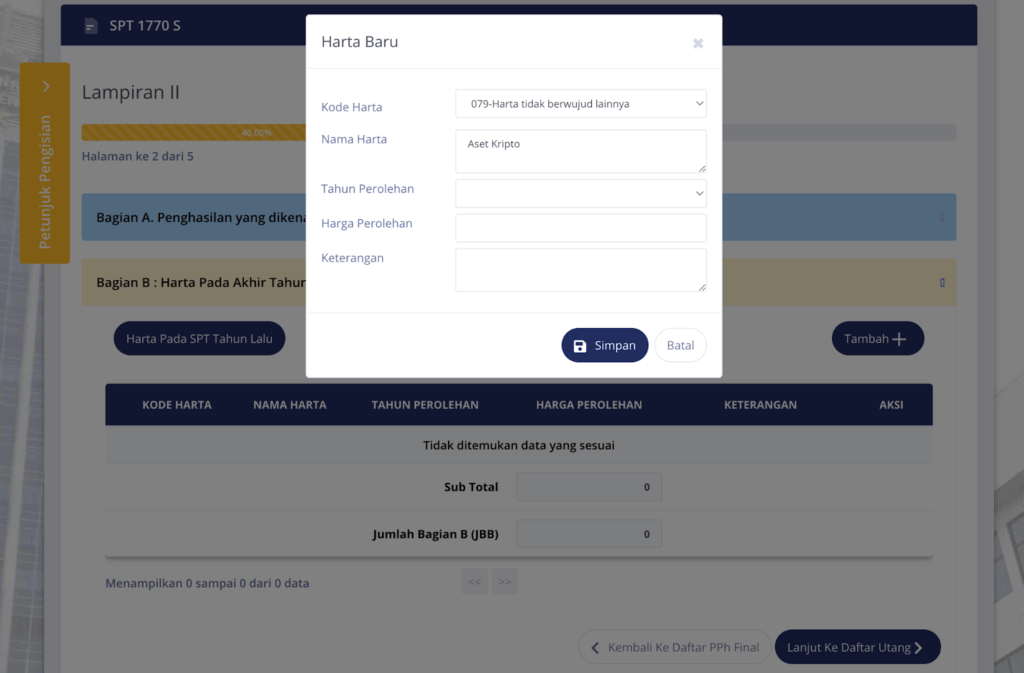

However, keep in mind that the information that must be filled in in this form is all transactions that are final, including transactions facilitated by platforms other than INDODAX.III. In Appendix II: Part B. Asset At The End Of The Year, INDODAX Members can update data of their assets last year by clicking Asset on last year’s SPT, or click Add for assets acquired and/or still owned as of December 31st, 2022.

IV. For crypto assets as of December 31st, 2022, choose 079-Other Intangible Assets in the Asset Code column and write Crypto Asset in the Asset Name. For information, the Acquisition Cost column is the purchase price of all crypto asset still owned as of December 31st of the tax reporting period. Acquisition Cost must all be filled for all crypto assets that were bought in crypto trading platforms, both domestic and abroad. - Continue filling out the SPT until the Get Verification Code stage, enter the verification code that will be sent via email, and click Send SPT.

- Crypto asset tax reporting is complete and proof of tax reporting will be sent by the Directorate General of Taxes via email.

For more Information and further inquiries, call Customer Support INDODAX via phone 021-50658888 (24 hours) or email at [email protected].

Regards,

INDODAX – Indonesia Bitcoin & Crypto Exchange